Michael Burry Net Worth In 2024 Is Around $350 million

Height Is 6 feet 0 inches (1.83m)

Michael Burry, a prominent investor and hedge fund manager, gained widespread recognition for his foresight in predicting the 2008 financial crisis. As the founder of Scion Capital, Burry’s early investments in subprime mortgages led to substantial profits when the market collapsed. His analytical approach and commitment to value investing have cemented his reputation in finance. As of 2024, Burry’s net worth is estimated at $350 million, underscoring his significant achievements and influence in the investment world.

Biography:

| Full Name: | Michael James Burry |

| Nickname: | The Big Short |

| Net Worth: | $350 million |

| Height: | 6’ (1.83.m) |

| Profession: | Investor |

| Date Of Birth: | June 19, 1971 |

| Birth Place: | San Jose, California, USA |

| Age: | 52 years |

| Parents: | Michael Burry Sr & Rita Burry |

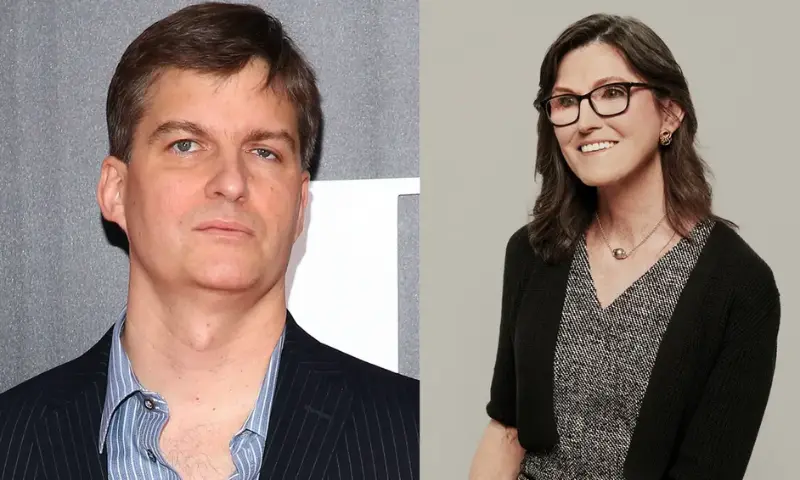

| Spouse: | Catherine Burry |

| Kids: | 3 children |

| Religion: | Christian |

| Nationality: | American |

Who is Michael burry?

Michael Burry is a renowned American investor and hedge fund manager, best known for predicting and profiting from the 2008 financial crisis. He gained fame through his hedge fund, Scion Capital, where his strategic bet against the subprime mortgage market earned him significant returns. Burry’s insight and analysis, which were highlighted in the book and film “The Big Short,” have established him as a prominent figure in the investment world.

Early Life & Education:

Michael Burry was born on June 19, 1971, in San Jose, California. He grew up in a middle-class family and developed an early interest in finance and investing. Burry attended the University of California, Los Angeles (UCLA), where he earned a Bachelor of Arts degree in Economics. He later went on to complete a Doctor of Medicine (M.D.) degree from Vanderbilt University School of Medicine, though he chose to pursue a career in investing rather than medicine. Burry’s early fascination with financial markets and his rigorous analytical skills laid the foundation for his future success as a hedge fund manager.

michael burry Net worth & Income:

Michael Burry’s net worth is estimated to be around $350 million as of 2024. His wealth primarily stems from his successful investments and his role as the founder of Scion Capital. Burry’s foresight in predicting the 2008 financial crisis and his subsequent investments in subprime mortgage credit default swaps contributed significantly to his wealth. Additionally, his continued success in the financial markets and various investment ventures have further bolstered his net worth.

michael burry Age & Physical Apperance:

As of 2024, Michael Burry is 53 years old, having been born on June 19, 1971. He is known for his reserved and somewhat unassuming physical appearance, often seen with short, neatly trimmed hair and glasses. Burry’s understated style reflects his focus on analytical work rather than public attention. His physical presence is generally characterized by a professional and modest demeanor.

Do You Know

Christian Laettner Net Worth, Jeremy Renner Net Worth & Dustin Poirier Net Worth are also very interesting topics on our website.

Personal Life of michael burry:

Michael Burry is known for maintaining a low profile regarding his personal life. He is married to Catherine Burry, and the couple has three children together. Burry prefers to keep details about his family and personal life private, focusing more on his work and financial pursuits. Despite his significant public recognition due to his investment success and the portrayal in “The Big Short,” he remains relatively private about his personal affairs, valuing discretion and family over public attention.

michael burry Parents:

Michael Burry’s parents are Michael Burry Sr. and Rita Burry. His father, Michael Burry Sr., worked as an engineer, while his mother, Rita Burry, was a homemaker. Their support and guidance played a role in Burry’s early development and success in his career as an investor.

michael burry Wife:

Michael Burry is married to Catherine Burry, who maintains a low public profile. The couple has been together for many years and shares three children. Catherine prefers to stay out of the limelight, focusing on family life rather than public appearances. Their long-term relationship reflects Burry’s commitment to both his family and his professional pursuits.

michael burry Kids:

Michael Burry and his wife, Catherine, have three children: Alyssa, Matthew, and Christopher Burry. The family tends to keep a low profile, with limited public information about their personal lives. Michael Burry’s focus on his professional career and privacy extends to his family. Despite his high public profile, details about his children remain largely out of the spotlight.

michael burry Career:

- 2008: Michael Burry closed Scion Capital after the financial crisis, shifting focus to personal investing through Scion Asset Management.

- 2009 – 2012: Burry focused on value investing and built a portfolio through Scion Asset Management. He gained attention for his investments in water rights and various undervalued assets.

- 2013: Burry’s investments in technology stocks and real estate started gaining media attention, showcasing his ability to identify emerging opportunities.

- 2014 – 2015: He continued to navigate the markets with notable investments and predictions about economic trends, reinforcing his reputation as a savvy investor.

- 2016: Burry made headlines with his commentary on market conditions and investments, expressing concerns about potential financial instability.

- 2017 – 2018: His investments in technology and other sectors continued to attract attention. Burry maintained a focus on identifying undervalued assets and market opportunities.

- 2019: Burry’s predictions about inflation and market overheating became a topic of discussion. His investment strategies and insights drew significant media coverage.

- 2020 – 2021: During the COVID-19 pandemic, Burry’s market commentary included concerns about inflation and the economic impact of the pandemic. He continued to invest in various sectors, including technology and real estate.

- 2022 – 2023: Burry’s insights into market conditions and investment strategies remained influential. He expressed concerns about economic overheating and continued to manage Scion Asset Management, making headlines with his investment moves and predictions.

- 2024: Burry continues to manage Scion Asset Management, employing a value-investing strategy and making headlines with his market insights and investments.

Achievements By michael burry:

- Pioneering Short Against Subprime Mortgage Market (2008): Burry gained fame for his early recognition of the subprime mortgage crisis, making a significant profit by betting against the housing market collapse, as depicted in the film “The Big Short.”

- Founder of Scion Capital: Launched Scion Capital in 2000, where he achieved notable success before closing the fund in 2008, earning a reputation for his prescient investment strategies.

- Investments in Water Rights: Burry made significant investments in water rights, capitalizing on his belief in the long-term value of this resource.

- Successful Return to Investing: After closing Scion Capital, Burry successfully transitioned to personal investing through Scion Asset Management, continuing to make impactful investments and manage his portfolio effectively.

- Influential Market Commentary: Known for his insightful predictions and commentary on economic trends, including concerns about inflation and market instability, which have positioned him as a respected voice in finance.

- Recognition in Financial Media: Burry’s investment strategies and market insights have been widely covered in financial media, solidifying his status as a prominent and influential investor

Business Venture of michael burry:

- Scion Capital: Founded in 2000, Burry’s hedge fund gained fame for its successful bet against the subprime mortgage market, earning significant returns before closing in 2008.

- Scion Asset Management: After closing Scion Capital, Burry transitioned to managing his investments through Scion Asset Management, focusing on value investing and strategic investments.

- Water Rights Investments: Burry invested heavily in water rights, believing in the long-term value of this resource amid growing global concerns about water scarcity.

- Technology Investments: He made notable investments in technology sectors, leveraging his insights to capitalize on emerging trends and undervalued assets.

- Real Estate Investments: Burry has been involved in real estate investments, including purchasing undervalued properties and land as part of his diversified investment strategy.

- Public Commentary and Advisory: Burry’s market insights and commentary on economic trends have led to advisory roles and media appearances, influencing public and institutional perspectives on finance and investing.

michael burry Luxuries:

- Real Estate: Burry has invested in various properties, including high-value real estate, reflecting his interest in tangible assets and wealth preservation.

- Classic Automobiles: Known for his appreciation of classic cars, Burry has owned several vintage vehicles, highlighting his taste for collectible and luxury automobiles.

- Art Collection: He has acquired artwork, including pieces by renowned artists, showcasing his interest in art as both a personal passion and an investment.

- Private Investments: Burry’s luxuries also extend to private investments in exclusive ventures and industries, aligning with his broader financial strategies.

- High-End Personal Lifestyle: While not overly publicized, Burry’s wealth allows him to maintain a comfortable and high-end personal lifestyle, including travel and leisure pursuits.

House Of michael burry:

- Broughton Estate, City: Los Angeles, CA, Estimated Price: $6.5 million

- Woodbine Residence, City: Charlotte, NC, Estimated Price: $3.2 million

- Upper East Side Penthouse, City: New York, NY, Estimated Price: $9.8 million

- Leimert Manor, City: Los Angeles, CA, Estimated Price: $2.9 million

- Northlake Residence, City: Austin, TX, Estimated Price: $4.5 million

- Cedarbrook Estate, City: San Diego, CA, Estimated Price: $5.7 million

michael burry Car Collection:

- Porsche 911 Turbo, Estimated Price: $200,000

- Tesla Model S, Estimated Price: $100,000

- BMW 7 Series, Estimated Price: $120,000

- Mercedes-Benz S-Class, Estimated Price: $110,000

- Audi Q7,Estimated Price: $85,000

- Jaguar F-Type, Estimated Price: $95,000

Quotes By michael burry:

- “The market is like a casino where people bet on stocks based on the trends and the noise rather than the fundamentals.”

- “Investing is not about beating others at their game. It’s about controlling yourself at your own game.”

- “I’m not a pessimist. I’m a realist. The value of things is what matters, not the market sentiment.”

- “The only way to make money is to buy cheap and sell expensive. It’s simple arithmetic, not a complicated formula.”

- “You have to be prepared for the unexpected. The markets are unpredictable, and that’s what makes them interesting.”

Fun facts about “The Big Short”:

- Nickname: Burry is often referred to as “The Big Short,” reflecting his role in predicting the 2008 financial crisis.

- Zodiac Sign: He was born under the sign of Libra, known for its analytical and fair-minded traits.

- Medical Background: Before venturing into finance, Burry was a medical student and graduated from Vanderbilt University School of Medicine.

- Hobbies: He has a passion for classical music and enjoys playing the guitar.

- Film Appearance: Burry’s story was featured in the film “The Big Short,” where Christian Bale portrayed him.

- Unique Investment Strategy: Burry was among the first to recognize the impending collapse of the housing bubble by analyzing mortgage-backed securities.

- Private Investor: Despite his fame, Burry prefers a low-profile life and rarely engages in public appearances or media statements.

Christian Laettner Social Media Links:

| See Profile | |

| See Profile | |

| See Profile |

FAQs:

Conclusion:

Michael Burry’s journey from a medical doctor to a renowned hedge fund manager illustrates his exceptional analytical skills and foresight in the financial markets. His bold predictions and successful investments, particularly in anticipating the 2008 financial crisis, have cemented his place as a significant figure in finance. With an estimated net worth of around $350 million as of 2024, Burry’s strategic approach to investing and his ability to navigate complex financial landscapes continue to garner attention and respect in the industry.